生物多样性 ›› 2025, Vol. 33 ›› Issue (8): 25125. DOI: 10.17520/biods.2025125 cstr: 32101.14.biods.2025125

收稿日期:2025-04-02

接受日期:2025-09-09

出版日期:2025-08-20

发布日期:2025-09-19

通讯作者:

*E-mail: wzq@sxu.edu.cn

基金资助:

Zhongqing Wang*( )(

)( ), Zhiwei Hu(

), Zhiwei Hu( )

)

Received:2025-04-02

Accepted:2025-09-09

Online:2025-08-20

Published:2025-09-19

Contact:

*E-mail: wzq@sxu.edu.cn

Supported by:摘要:

党的二十届三中全会明确指出, 强化生物多样性保护工作协调机制, 积极完善绿色金融和市场信息披露制度, 深化环境信息依法披露制度改革。生物遗传资源获取和惠益分享作为全球生物多样性保护和可持续利用领域的关注焦点, 信息披露高度契合了《昆明-蒙特利尔全球生物多样性框架》、绿色金融和信息驱动型自我规制等法治实践与理论基础。上市公司深度参与生物遗传资源国内配置和跨境流动, 应当是获取和惠益分享信息披露主题研究的典型样本, 本文通过整理2021-2023年度沪深证券交易所660份涵盖生物多样性主题的上市公司《可持续发展报告》, 从宏观与微观两个维度展开实证分析, 对于完善我国生物遗传资源获取和惠益分享机制具有路径指引和规范作用。目前, 实践中主要存在获取和惠益分享信息披露与绿色金融衔接不足、立法进展与自律规制指引受限、信息披露关联主体权义配置失衡等困境。未来需要强化获取和惠益分享信息披露与绿色金融的纵深联结、完善立法进展与自律规制的规范指引、健全获取和惠益分享信息披露的制度体系。

王中庆, 胡志伟 (2025) 我国上市公司生物遗传资源获取和惠益分享信息披露实证研究. 生物多样性, 33, 25125. DOI: 10.17520/biods.2025125.

Zhongqing Wang, Zhiwei Hu (2025) Empirical study on access and benefit-sharing information disclosure of biological genetic resources by Chinese listed companies. Biodiversity Science, 33, 25125. DOI: 10.17520/biods.2025125.

| 样本特征 Sample characteristics | 划分类型 Classification | 2021 (n = 1,320) | 2022 (n = 1,609) | 2023 (n = 2,128) | |||

|---|---|---|---|---|---|---|---|

| 频数 Frequency | 比例 Proportion (%) | 频数 Frequency | 比例 Proportion (%) | 频数 Frequency | 比例 Proportion (%) | ||

| 公司总量 Total number of companies | 生物多样性 Biodiversity | 46 | 3.48 | 193 | 11.99 | 421 | 19.78 |

| 生物遗传资源获取和惠益分享 Access and benefit-sharing on biological genetic resources | 5 | 0.38 | 14 | 0.87 | 16 | 0.75 | |

| 关联主题 Related topics | 生物遗传资源可持续利用 Sustainable utilization of biological genetic resources | 4 | 0.30 | 13 | 0.80 | 18 | 0.85 |

| 野生动植物保护 Wildlife protection | 28 | 2.12 | 77 | 4.79 | 174 | 8.18 | |

| 防止外来物种入侵 Prevention of invasive alien species | 0 | 0 | 5 | 0.31 | 13 | 0.61 | |

| 公司性质 Nature of the companies | 国企 State-owned enterprises | 3 | 0.23 | 9 | 0.56 | 12 | 0.56 |

| 民企 Private enterprises | 2 | 0.15 | 5 | 0.31 | 4 | 0.19 | |

表1 2021-2023年我国上市公司生物遗传资源获取和惠益分享信息披露的整体状况。数据来源: 沪深证券交易所上市公司可持续发展报告。

Table 1 Overall status of access and benefit-sharing information disclosure of biological genetic resources by Chinese listed companies from 2021 to 2023. Data source: Sustainability reports of listed companies on the Shanghai Stock Exchanges and Shenzhen Stock Exchanges.

| 样本特征 Sample characteristics | 划分类型 Classification | 2021 (n = 1,320) | 2022 (n = 1,609) | 2023 (n = 2,128) | |||

|---|---|---|---|---|---|---|---|

| 频数 Frequency | 比例 Proportion (%) | 频数 Frequency | 比例 Proportion (%) | 频数 Frequency | 比例 Proportion (%) | ||

| 公司总量 Total number of companies | 生物多样性 Biodiversity | 46 | 3.48 | 193 | 11.99 | 421 | 19.78 |

| 生物遗传资源获取和惠益分享 Access and benefit-sharing on biological genetic resources | 5 | 0.38 | 14 | 0.87 | 16 | 0.75 | |

| 关联主题 Related topics | 生物遗传资源可持续利用 Sustainable utilization of biological genetic resources | 4 | 0.30 | 13 | 0.80 | 18 | 0.85 |

| 野生动植物保护 Wildlife protection | 28 | 2.12 | 77 | 4.79 | 174 | 8.18 | |

| 防止外来物种入侵 Prevention of invasive alien species | 0 | 0 | 5 | 0.31 | 13 | 0.61 | |

| 公司性质 Nature of the companies | 国企 State-owned enterprises | 3 | 0.23 | 9 | 0.56 | 12 | 0.56 |

| 民企 Private enterprises | 2 | 0.15 | 5 | 0.31 | 4 | 0.19 | |

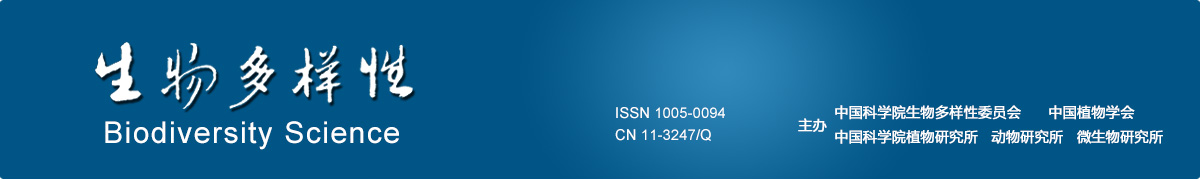

图1 2021-2023年披露生物遗传资源获取和惠益分享(ABS)信息的上市公司区域位置(A)、行业类型(B)和参照标准(C)。数据来源: 沪深证券交易所上市公司可持续发展报告。无数据的省(市、自治区)未在图A中显示。图B和图C从内圈到外圈依次为2021年、2022年和2023年。

Fig. 1 The regional location (A), industry classification (B) and reference standards (C) of access and benefit-sharing (ABS) information disclosure of biological genetic resources by Chinese listed companies from 2021 to 2023. Data source: Sustainability reports of listed companies on the Shanghai Stock Exchange and Shenzhen Stock Exchange. Provinces (municipalities, autonomous regions) with no data are not shown in Figure A. Figures B and C show the years 2021, 2022 and 2023 in order from the inner circle to the outer circle.

| 体系框架 System frameworks | 主要内容 Main contents | 2021 (n = 5) | 2022 (n = 14) | 2023 (n = 16) | |||

|---|---|---|---|---|---|---|---|

| 频数 Frequency | 比例 Proportion (%) | 频数 Frequency | 比例 Proportion (%) | 频数 Frequency | 比例 Proportion (%) | ||

| 具体目标 Specific objectives | 获取和惠益分享目标 Access and benefit-sharing objectives | 0 | 0 | 0 | 0 | 0 | 0 |

| 参与主体 Participating entities | 国家联络点 National focal point | 0 | 0 | 0 | 0 | 0 | 0 |

| 国家主管部门 Competent national authority | 0 | 0 | 0 | 0 | 0 | 0 | |

| 提供者(当地社区和原住居民) Providers (local communities and indigenous peoples) | 0 | 0 | 0 | 0 | 1 | 6.25 | |

| 使用者(引入、研究和开发) Users (introduction, research and development) | 3 | 60.00 | 6 | 42.86 | 11 | 68.75 | |

| 适用对象 Applicable objects | 生物遗传资源(种质资源) Biological genetic resources (germplasm resources) | 4 | 80.00 | 5 | 35.71 | 11 | 68.75 |

| 相关传统知识 Relevant traditional knowledge | 0 | 0 | 0 | 0 | 0 | 0 | |

| 衍生物 Derivatives | 0 | 0 | 0 | 0 | 0 | 0 | |

| 运行机制 Operational mechanisms | 来源披露程序 Procedure for disclosure of origin | 0 | 0 | 0 | 0 | 1 | 6.25 |

| 事先知情同意 Prior informed consent | 0 | 0 | 0 | 0 | 0 | 0 | |

| 共同商定条件 Mutually agreed terms | 0 | 0 | 0 | 0 | 0 | 0 | |

| 惠益类型 Benefit types | 货币惠益 Monetary benefits | 0 | 0 | 0 | 0 | 0 | 0 |

| 非货币惠益 Non-monetary benefits | 0 | 0 | 0 | 0 | 0 | 0 | |

| 国际文件 International documents | 生物多样性公约 Convention on Biological Diversity | 3 | 60.00 | 4 | 28.57 | 4 | 25.00 |

| 生物多样性公约关于获取遗传资源和公正和公平分享其利用所产生惠益的名古屋议定书 Nagoya Protocol on Access to Genetic Resources and the Fair and Equitable Sharing of Benefits Arising from Their Utilization to the Convention on Biological Diversity | 0 | 0 | 0 | 0 | 0 | 0 | |

| 昆明-蒙特利尔全球生物多样性框架 Kunming-Montreal Global Biodiversity Framework | 0 | 0 | 1 | 7.14 | 1 | 6.25 | |

| 基金支持 Fund support | 生物多样性保护基金 Biodiversity Conservation Fund | 0 | 0 | 0 | 0 | 1 | 6.25 |

表2 我国上市公司生物遗传资源获取和惠益分享信息披露的具体情况。数据来源: 沪深证券交易所上市公司可持续发展报告。

Table 2 Specific details of access and benefit-sharing information disclosure of biological genetic resources by Chinese listed companies. Data source: Sustainability reports of listed companies on the Shanghai Stock Exchange and Shenzhen Stock Exchange.

| 体系框架 System frameworks | 主要内容 Main contents | 2021 (n = 5) | 2022 (n = 14) | 2023 (n = 16) | |||

|---|---|---|---|---|---|---|---|

| 频数 Frequency | 比例 Proportion (%) | 频数 Frequency | 比例 Proportion (%) | 频数 Frequency | 比例 Proportion (%) | ||

| 具体目标 Specific objectives | 获取和惠益分享目标 Access and benefit-sharing objectives | 0 | 0 | 0 | 0 | 0 | 0 |

| 参与主体 Participating entities | 国家联络点 National focal point | 0 | 0 | 0 | 0 | 0 | 0 |

| 国家主管部门 Competent national authority | 0 | 0 | 0 | 0 | 0 | 0 | |

| 提供者(当地社区和原住居民) Providers (local communities and indigenous peoples) | 0 | 0 | 0 | 0 | 1 | 6.25 | |

| 使用者(引入、研究和开发) Users (introduction, research and development) | 3 | 60.00 | 6 | 42.86 | 11 | 68.75 | |

| 适用对象 Applicable objects | 生物遗传资源(种质资源) Biological genetic resources (germplasm resources) | 4 | 80.00 | 5 | 35.71 | 11 | 68.75 |

| 相关传统知识 Relevant traditional knowledge | 0 | 0 | 0 | 0 | 0 | 0 | |

| 衍生物 Derivatives | 0 | 0 | 0 | 0 | 0 | 0 | |

| 运行机制 Operational mechanisms | 来源披露程序 Procedure for disclosure of origin | 0 | 0 | 0 | 0 | 1 | 6.25 |

| 事先知情同意 Prior informed consent | 0 | 0 | 0 | 0 | 0 | 0 | |

| 共同商定条件 Mutually agreed terms | 0 | 0 | 0 | 0 | 0 | 0 | |

| 惠益类型 Benefit types | 货币惠益 Monetary benefits | 0 | 0 | 0 | 0 | 0 | 0 |

| 非货币惠益 Non-monetary benefits | 0 | 0 | 0 | 0 | 0 | 0 | |

| 国际文件 International documents | 生物多样性公约 Convention on Biological Diversity | 3 | 60.00 | 4 | 28.57 | 4 | 25.00 |

| 生物多样性公约关于获取遗传资源和公正和公平分享其利用所产生惠益的名古屋议定书 Nagoya Protocol on Access to Genetic Resources and the Fair and Equitable Sharing of Benefits Arising from Their Utilization to the Convention on Biological Diversity | 0 | 0 | 0 | 0 | 0 | 0 | |

| 昆明-蒙特利尔全球生物多样性框架 Kunming-Montreal Global Biodiversity Framework | 0 | 0 | 1 | 7.14 | 1 | 6.25 | |

| 基金支持 Fund support | 生物多样性保护基金 Biodiversity Conservation Fund | 0 | 0 | 0 | 0 | 1 | 6.25 |

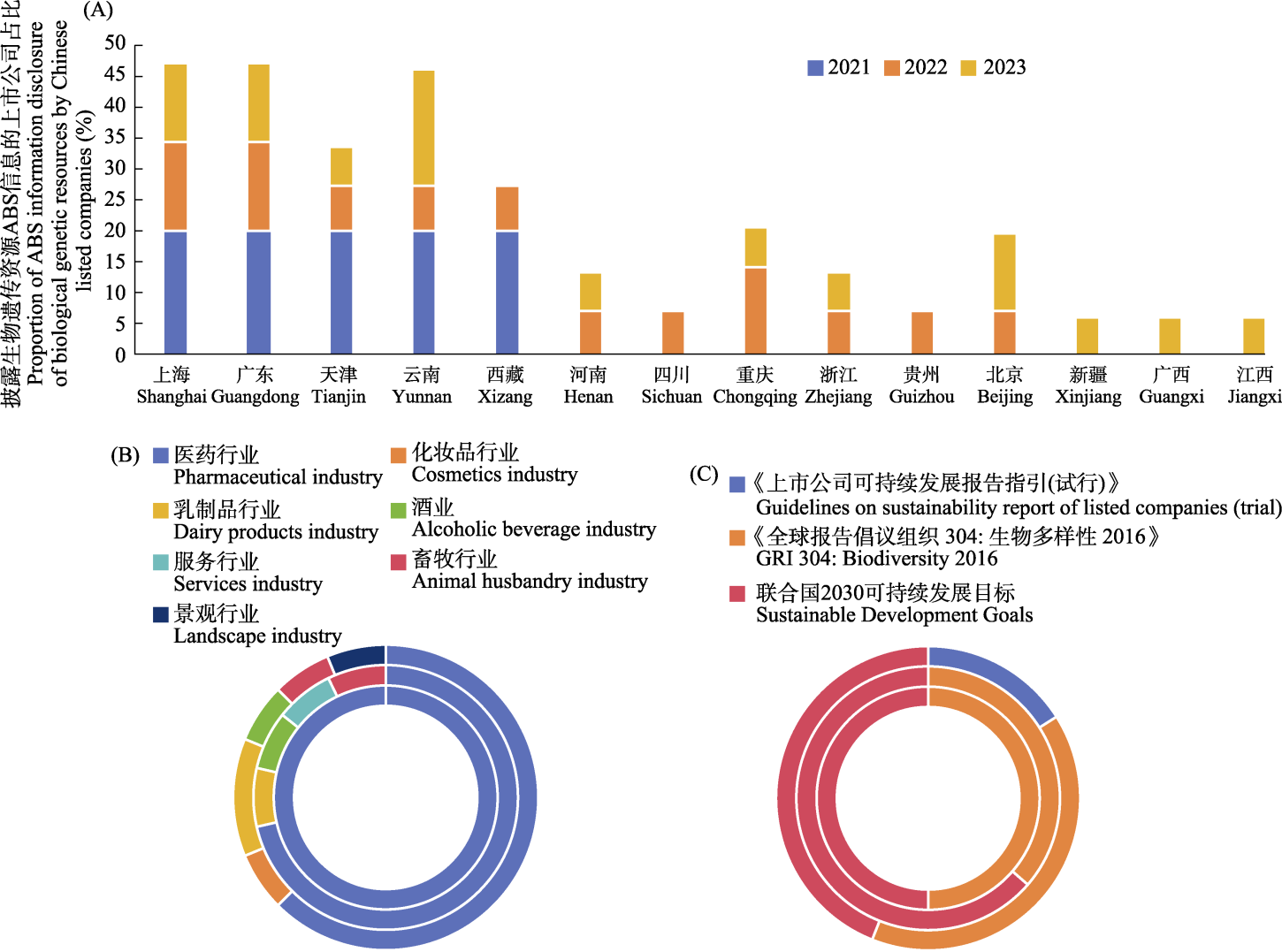

图2 信息披露关联主体权义配置失衡的逻辑框架

Fig. 2 Logical framework of the imbalance in the allocation of rights and obligations among stakeholders in information disclosure

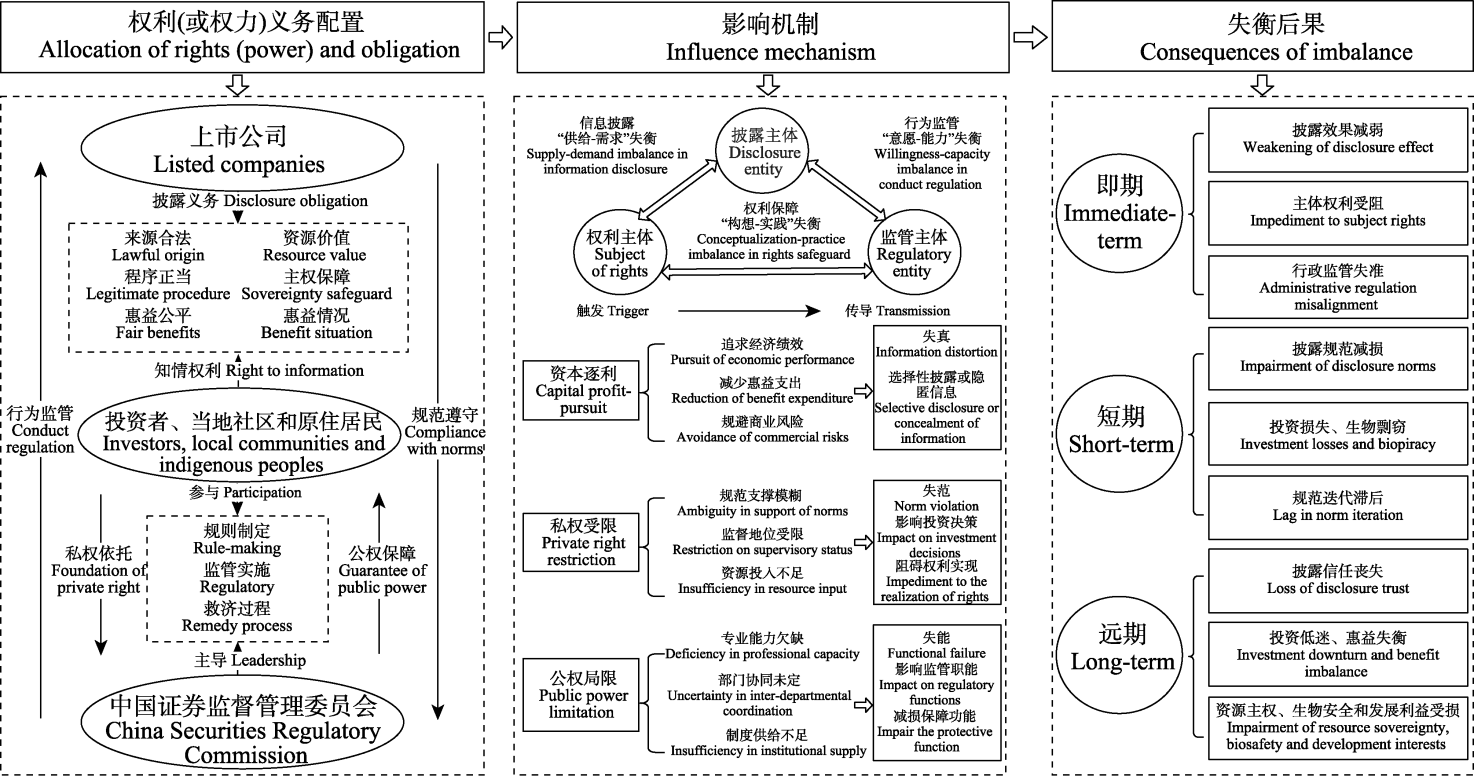

图3 我国上市公司生物遗传资源获取和惠益分享(ABS)信息披露要点

Fig. 3 Key elements of access and benefit-sharing (ABS) information disclosure of biological genetic resources by Chinese listed companies

| [1] | Chen B (2024) The rule of law transformation of green finance standards. Oriental Law, (2), 189-200. (in Chinese with English abstract) |

| [陈波 (2024) 绿色金融标准的法治转型. 东方法学, (2), 189-200.] | |

| [2] | Chen DD, Shi DM, Qi DY, Shi HM (2025) Green finance statistical standards: International comparison and practices in China. Statistical Research, 42(1), 75-87. (in Chinese with English abstract) |

| [陈丹丹, 史代敏, 祁丹越, 史皓铭 (2025) 绿色金融统计标准的国际比较与中国实践. 统计研究, 42(1), 75-87.] | |

| [3] | Cheng Y (2024) Between functionalism and normativism: Systematic control of ecological damage liability. Tsinghua University Law Journal, 18(3), 173-190. (in Chinese with English abstract) |

| [程玉 (2024) 在功能主义与规范主义之间: 生态损害责任的体系性控制. 清华法学, 18(3), 173-190.] | |

| [4] | China Securities Regulatory Commission (2024) Typical Cases of Investor Protection. (in Chinese) |

| [中国证券监督管理委员会 (2024) 《投资者保护典型案例》.] http://www.csrc.gov.cn/csrc/c100210/c7480514/7480514/files/2dd6c31639da4d8b8646f3980e568735.pdf . (accessed on 2024-05-15) | |

| [5] | Dong Y, Wu XH, Li Z (2024) How does green credit enhance corporate ESG performance? Evidence from Chinese A-share listed companies. Journal of Nanjing University of Finance and Economics, (4), 45-55. (in Chinese with English abstract) |

| [董雨, 吴心慧, 李周 (2024) 绿色信贷能否提升企业ESG表现?——来自中国A股上市公司的经验证据. 南京财经大学学报, (4), 45-55.] | |

| [6] | Fei YY, Yang YH (2022) Review on the rightness of property ownership of microbial genetic resources in China. Academic Exploration, (1), 80-87. (in Chinese with English abstract) |

| [费艳颖, 杨元海 (2022) 我国微生物遗传资源产权归属正当性审视. 学术探索, (1), 80-87.] | |

| [7] | Grandall Financial and Securities Compliance Practice Committee & Legal Research Center (2025) Annual review of securities administrative penalties (2024). (in Chinese) |

| [国浩金融证券合规业务委员会暨法律研究中心 (2025) 《证券行政处罚2024年度综述》] https://www.grandall.com.cn/ghsd/info.aspx?itemid=30432 . (accessed on 2025-01-20) | |

| [8] | Huang SZ, Zhou J (2025) An empirical study for the impact of green finance on carbon information disclosure quality. Journal of Statistics and Information, 40(1), 65-76. (in Chinese with English abstract) |

| [黄胜忠, 周军 (2025) 绿色金融对企业碳信息披露质量影响的实证研究. 统计与信息论坛, 40(1), 65-76.] | |

| [9] |

Jia SQ, Zhang JB (2024) Necessity and response of the special legislation on access and benefit sharing of biological genetic resources. Biodiversity Science, 32, 24383. (in Chinese with English abstract)

DOI |

|

[贾韶琦, 张巨保 (2024) 生物遗传资源获取与惠益分享专门立法的重启必要与现实回应. 生物多样性, 32, 24383.]

DOI |

|

| [10] | Li C, Li GL (2024) Emerging trends in global ESG assurance and China’s response strategies. Finance and Accounting Monthly, 45(22), 83-88. (in Chinese) |

| [李超, 李光禄 (2024) 国际ESG报告鉴证发展新动向及我国的应对策略. 财会月刊, 45(22), 83-88.] | |

| [11] | Li CX, Zhang YD (2024) Jurisprudential foundations and institutional framework of ESG disclosure regulation for listed companies. Jianghan Tribune, (9), 140-144. (in Chinese) |

| [李传轩, 张叶东 (2024) 上市公司ESG信息披露监管的法理基础与制度构建. 江汉论坛, (9), 140-144.] | |

| [12] | Li YD (2023) Kunming-Montreal Global Biodiversity Framework: Key elements, focuses and local rules response. Pacific Journal, 31(8), 88-100. (in Chinese with English abstract) |

| [李一丁 (2023) 《昆明-蒙特利尔全球生物多样性框架》: 要义、焦点与本土规范回应. 太平洋学报, 31(8), 88-100.] | |

| [13] | Li YD (2024) An analysis and response to RCEP’s provisions on genetic resources, traditional knowledge and folklore. Journal of Gansu University of Political Science and Law, (4), 36-48. (in Chinese) |

| [李一丁 (2024) RCEP遗传资源、传统知识和民间文学艺术条款析解与因应. 甘肃政法大学学报, (4), 36-48.] | |

| [14] | Liu S (2025) On the dual governance model of financial regulation transparency in China. China Legal Science, (4), 26-45. (in Chinese with English abstract) |

| [刘盛 (2025) 论我国金融监管透明度的二元治理模式. 中国法学, (4), 26-45.] | |

| [15] | Liu SY (2025) Research on the domestic application of international biodiversity conventions. Wuhan University International Law Review, 9(2), 87-103. (in Chinese with English abstract) |

| [刘斯羽 (2025) 生物多样性国际条约的国内适用问题研究. 武大国际法评论, 9(2), 87-103.] | |

| [16] | Lou QR (2023) ESG information disclosure: Legal principle reflection and institutional construction. Securities Market Herald, (3), 24-34. (in Chinese with English abstract) |

| [楼秋然 (2023) ESG信息披露: 法理反思与制度建构. 证券市场导报, (3), 24-34.] | |

| [17] | Qi F, Qiu S, Huang T (2024) International practices and implications of biodiversity information disclosure standards. Finance and Accounting, (19), 75-79. (in Chinese) |

| [齐飞, 邱双, 黄婷 (2024) 生物多样性信息披露标准的国际实践与启示. 财务与会计, (19), 75-79.] | |

| [18] | Qian LH, Zhou R, Fang Q, Lu ZW (2020) The risks and opportunities of green finance boosting biodiversity protection. Environmental Protection, 48(12), 30-34. (in Chinese) |

| [钱立华, 周嵘, 方琦, 鲁政委 (2020) 绿色金融助力生物多样性保护的风险与机遇. 环境保护, 48(12), 30-34.] | |

| [19] | Qin TB (2021) On the development of risk prevention principle in environmental law: A combination with the investigation of “Biosecurity Law”. China Law Review, (2), 65-79. (in Chinese) |

| [秦天宝 (2021) 论风险预防原则在环境法中的展开——结合《生物安全法》的考察. 中国法律评论, (2), 65-79.] | |

| [20] | Qin TB (2025) Functional positioning and optimization path of legal disclosure of environmental information. Political Science and Law, (2), 115-129. (in Chinese with English abstract) |

| [秦天宝 (2025) 环境信息依法披露的功能定位与优化路径. 政治与法律, (2), 115-129.] | |

| [21] | Song XX, Wang AP, Hu HF (2025) Green investor and corporate green innovation: From the perspective of institutional investor attention. Studies of International Finance, (2), 85-96. (in Chinese with English abstract) |

| [宋肖肖, 王爱萍, 胡海峰 (2025) 绿色投资者与企业绿色创新: 基于机构投资者注意力视角. 国际金融研究, (2), 85-96.] | |

| [22] | Tang Y (2011) Protection of biological genetic resources in the framework of “The Nagoya Protocol”. Journal of Guizhou Normal University (Social Sciences Edition), (6), 64-70. (in Chinese with English abstract) |

| [汤跃 (2011) 《名古屋议定书》框架下的生物遗传资源保护. 贵州师范大学学报(社会科学版), (6), 64-70.] | |

| [23] | Wang SG, Liu YJZ (2024) China’s green finance governance: Compatibility of multiple objectives and dynamic balance of the system. Ningxia Social Sciences, (6), 101-113. (in Chinese with English abstract) |

| [王曙光, 刘杨婧卓 (2024) 中国绿色金融治理: 多元目标兼容与系统动态平衡. 宁夏社会科学, (6), 101-113.] | |

| [24] | Wang ZQ (2024) On the data law regulation of digital sequence information on genetic resources. Academic Exchange, (7), 43-56. (in Chinese) |

| [王中庆 (2024) 论遗传资源数字序列信息的数据法规制. 学术交流, (7), 43-56.] | |

| [25] | Wang ZQ, Zhao YH (2024) Normative path of corporate climate information disclosure standard under ESG concept. Environmental Protection, 52(19), 16-20. (in Chinese) |

| [王中庆, 赵宇虹 (2024) ESG理念下企业气候信息披露标准的规范路径. 环境保护, 52(19), 16-20.] | |

| [26] | Wu CH, Wei J (2023) Optimization of the typing system of environmental information disclosure by financial institutions: EU experience and China’s approach. Journal of Shanghai University of Finance and Economics, 25(3), 138-152. (in Chinese with English abstract) |

| [武长海, 韦洁 (2023) 金融机构环境信息披露类型体系的优化: 欧盟经验与中国方案. 上海财经大学学报, 25(3), 138-152.] | |

| [27] | Xu FY, Sun JY, Liu W (2025) A study on the impact of environmental information disclosure on OFDI of the enterprises: Empirical evidence from the companies listed on Chinese A-share market. International Economics and Trade Research, 41(1), 69-86. (in Chinese with English abstract) |

| [徐芳燕, 孙静怡, 刘巍 (2025) 环境信息披露对企业对外直接投资的影响研究——来自中国上市公司的经验证据. 国际经贸探索, 41(1), 69-86.] | |

| [28] | Ye WP (2025) The rise of ESG litigation: Centered on governance of information disclosure. Political Science and Law, (8), 49-65. (in Chinese with English abstract) |

| [叶榅平 (2025) ESG诉讼的兴起: 以信息披露治理为中心. 政治与法律, (8), 49-65.] | |

| [29] | Yuan X, Liao YC (2019) Analysis on the institutional construction for acquisition and benefit-sharing of marine genetic resources in areas beyond national jurisdiction. Journal of Nanchang University (Humanities and Social Sciences), 50(5), 73-84. (in Chinese with English abstract) |

| [袁雪, 廖宇程 (2019) 国家管辖范围外区域海洋遗传资源获取和惠益分享的制度化建构. 南昌大学学报(人文社会科学版), 50(5), 73-84.] | |

| [30] | Zhang B (2018) The Legal Framework of Environmental Regulation. Peking University Press, Beijing. (in Chinese) |

| [张宝 (2018) 环境规制的法律构造. 北京大学出版社, 北京.] | |

| [31] | Zheng P, Li F (2024) Further deepen the theoretical connotation, historical logic and practical path of the financial reform with Chinese characteristics. Finance & Economics, (12), 43-53. (in Chinese with English abstract) |

| [郑鹏, 李峰 (2024) 进一步深化中国特色金融改革的理论内涵、历史逻辑及现实路径. 财经科学, (12), 43-53.] | |

| [32] | Zheng SH, Wang H (2024) Evolution, logic, and implementation of ESG. Journal of Shanghai University of Finance and Economics, 26(4), 124-138. (in Chinese with English abstract) |

| [郑少华, 王慧 (2024) ESG的演变、逻辑及其实现. 上海财经大学学报, 26(4), 124-138.] | |

| [33] | Zhou HC (2024) Opportunities, challenges, transformation paths and policy recommendations for green development of the Yangtze River Economic Belt. Journal of Poyang Lake, (1), 5-19, 155. (in Chinese with English abstract) |

| [周宏春 (2024) 长江经济带绿色发展的机遇挑战、转型路径与对策建议. 鄱阳湖学刊, (1), 5-19, 155.] |

| [1] | 汤心萌, 秦涛. 中国企业生物多样性信息披露指数构建及融资效应[J]. 生物多样性, 2025, 33(1): 24264-. |

| [2] | 赵富伟, 李颖硕, 陈慧. 新时期我国生物多样性法制建设思考[J]. 生物多样性, 2024, 32(5): 24027-. |

| [3] | 贾韶琦, 张巨保. 生物遗传资源获取与惠益分享专门立法的重启必要与现实回应[J]. 生物多样性, 2024, 32(11): 24383-. |

| [4] | 张文斐, 江知禾. 育种产业化背景下生物遗传资源安全: 趋势研判、现实困境及实现机制[J]. 生物多样性, 2024, 32(11): 24274-. |

| [5] | 赵阳, 李宏涛. 企业生物多样性信息披露: 调查、分析与建议[J]. 生物多样性, 2022, 30(11): 22049-. |

| [6] | 张小勇. 《名古屋议定书》在微生物领域的实施: 影响、最佳做法及我国立法选择[J]. 生物多样性, 2020, 28(10): 1292-1299. |

| [7] | 李一丁. “一带一路”与生物遗传资源获取和惠益分享: 关联、路径与策略[J]. 生物多样性, 2019, 27(12): 1386-1392. |

| 阅读次数 | ||||||

|

全文 |

|

|||||

|

摘要 |

|

|||||

备案号:京ICP备16067583号-7

Copyright © 2022 版权所有 《生物多样性》编辑部

地址: 北京香山南辛村20号, 邮编:100093

电话: 010-62836137, 62836665 E-mail: biodiversity@ibcas.ac.cn