Biodiv Sci ›› 2024, Vol. 32 ›› Issue (2): 23300. DOI: 10.17520/biods.2023300 cstr: 32101.14.biods.2023300

• Conservation and Governance • Previous Articles Next Articles

Yunyue Peng*( )(

)( ), Tong Jin(

), Tong Jin( ), Xiaoquan Zhang

), Xiaoquan Zhang

Received:2023-08-24

Accepted:2023-12-22

Online:2024-02-20

Published:2024-01-11

Contact:

E-mail: CLC Number:

Yunyue Peng, Tong Jin, Xiaoquan Zhang. Biodiversity credits: Concepts, principles, transactions and challenges[J]. Biodiv Sci, 2024, 32(2): 23300.

| 项目类型 Scheme type | 适用情况 Applicability | 单位 Unit type | 目标 Objective |

|---|---|---|---|

| 生物多样性抵消项目 Biodiversity offset scheme | 强制或自愿 Compliance or voluntary | 生物多样性抵消 Biodiversity offsets | 生物多样性无净损失或产生生物多样性净增长/净正向影响 No net loss of biodiversity or biodiversity net gain/net positive impacts |

| 生物多样性信用项目 Biodiversity credit scheme | 自愿 Voluntary | 生物多样性信用 Biodiversity credits | 正向的生物多样性成果 Positive biodiversity outcomes |

Table 1 Key attributes of biodiversity offset and biodiversity credit schemes

| 项目类型 Scheme type | 适用情况 Applicability | 单位 Unit type | 目标 Objective |

|---|---|---|---|

| 生物多样性抵消项目 Biodiversity offset scheme | 强制或自愿 Compliance or voluntary | 生物多样性抵消 Biodiversity offsets | 生物多样性无净损失或产生生物多样性净增长/净正向影响 No net loss of biodiversity or biodiversity net gain/net positive impacts |

| 生物多样性信用项目 Biodiversity credit scheme | 自愿 Voluntary | 生物多样性信用 Biodiversity credits | 正向的生物多样性成果 Positive biodiversity outcomes |

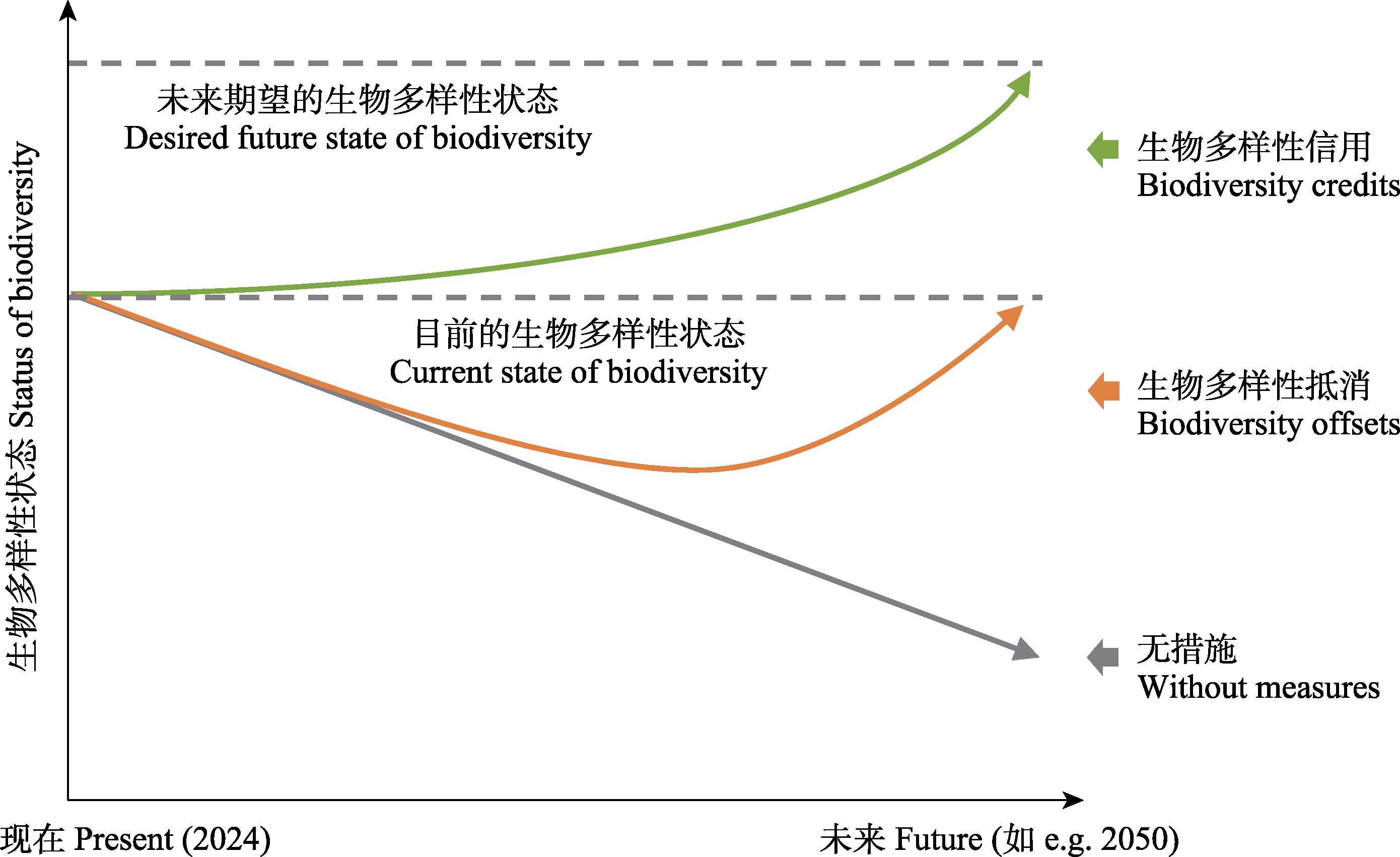

Fig. 1 Biodiversity offsets and biodiversity credits to achieve corporate nature-positive goals (Adapted from Milner-Gulland et al (2021) and Koh et al (2022))

| 国家或地区 Countries or regions | 项目类型 Project type | |||

|---|---|---|---|---|

| PL | GL | UL | IS* | |

| 澳大利亚 Australia | √ | √ | √ | |

| 新西兰 New Zealand | √ | √ | ||

| 纽埃 Niue | √ | |||

| 印度 India | √ | |||

| 南非 South Africa | √ | |||

| 加蓬 Gabon | √ | |||

| 哥伦比亚 Colombia | √ | |||

| 巴西 Brazil | √ | |||

| 英国 United Kingdom | √ | √ | √ | √ |

| 瑞士 Switzerland | √ | |||

| 瑞典 Sweden | √ | |||

| 法国 France | √ | |||

| 南美洲 South America | √ | |||

| 非洲 Africa | √ | |||

| 国际 International | √ | √ | ||

Table 2 Distribution and project types of partial global biodiversity credits market initiatives

| 国家或地区 Countries or regions | 项目类型 Project type | |||

|---|---|---|---|---|

| PL | GL | UL | IS* | |

| 澳大利亚 Australia | √ | √ | √ | |

| 新西兰 New Zealand | √ | √ | ||

| 纽埃 Niue | √ | |||

| 印度 India | √ | |||

| 南非 South Africa | √ | |||

| 加蓬 Gabon | √ | |||

| 哥伦比亚 Colombia | √ | |||

| 巴西 Brazil | √ | |||

| 英国 United Kingdom | √ | √ | √ | √ |

| 瑞士 Switzerland | √ | |||

| 瑞典 Sweden | √ | |||

| 法国 France | √ | |||

| 南美洲 South America | √ | |||

| 非洲 Africa | √ | |||

| 国际 International | √ | √ | ||

| [1] | Bai YW, Yao JR, Chen YJ, Shi LL, Shen TT, Yu YH, Wen YQ, Wu M (2023) Study on key issues in financial institutions’ support for biodiversity conservation. In: Annual Report 2023: Harnessing Biodiversity Finance for People and Planet. China Financial Publishing House, Beijing. (in Chinese) |

| [白韫雯, 姚靖然, 陈蓥婕, 石玲玲, 申屠婷, 俞婴红, 温姚琪, 吴敏 (2023) 金融机构支持生物多样性保护关键问题研究. 见: 人与自然和谐共生: 生物多样性金融2023年度报告. 中国金融出版社, 北京.] | |

| [2] | Benedito F, Sarmiento M (2022) Biodiversity Credit Market Must Learn from Carbon Offset Mistakes (Commentary). https://news.mongabay.com/2022/11/biodiversity-credit-market-must-learn-from-carbon-offset-mistakes-commentary/. (accessed on 2023-08-16) |

| [3] | CBD Convention on Biological Diversity (2022) Kunming- Montreal Global Biodiversity Framework: Draft Decision Submitted by the President. https://www.cbd.int/doc/c/e6d3/cd1d/daf663719a03902a9b116c34/cop-15-l-25-en.pdf. (accessed on 2023-08-21) |

| [4] | Chen YH, Pan Y (2021) Biodiversity, biodiversity finance and financial stability. Financial Accounting, (11), 56-62. (in Chinese) |

| [陈燕和, 潘玉 (2021) 生物多样性、生物多样性融资与金融稳定. 金融会计, (11), 56-62.] | |

| [5] |

Cui CY, Hou YL, Wang TY, Wen YL (2022) Biodiversity conservation supported by finance: Global practice and policy enlightenment. Biodiversity Science, 30, 22326. (in Chinese with English abstract)

DOI |

|

[崔楚云, 侯一蕾, 王天一, 温亚利 (2022) 金融支持生物多样性保护: 全球实践及政策启示. 生物多样性, 30, 22326.]

DOI |

|

| [6] | Deutz A, Heal GM, Niu R, Swanson E, Townshend T, Li Z, Delmar A, Meghji A, Sethi SA la Puente JT (2020) Financing Nature:Closing the Global Biodiversity Financing Gap. The Paulson Institute, Chicago, The Nature Conservancy, Arlington, and the Cornell Atkinson Center for Sustainability, New York. https://www.paulsoninstitute.org/wp-content/uploads/2020/10/FINANCING-NATURE_Full-Report_Final-with-endorsements_101420.pdf. (accessed on 2023-08-16) |

| [7] | Ducros A, Steele P (2022) Biocredits to Finance Nature and People: Emerging Lessons. International Institute for Environment and Development (IIED), London & Edinburgh. https://www.iied.org/sites/default/files/pdfs/2022-11/21216IIED.pdf. (accessed on 2023-08-16) |

| [8] | FFI Fauna Flora International,PVF (Plan Vivo Foundation) (2023) High-level Integrity Principles Developed to Steer Emerging Biodiversity Credits Market. https://www.planvivo.org/news/biodiversity-high-level-integrity-principles. (accessed on 2023-08-17) |

| [9] | Gray C, Khatri A (2022) How Biodiversity Credits can Deliver Benefits for Business, Nature and Local Communities. https://www.weforum.org/agenda/2022/12/biodiversity-credits-nature-cop15/. (accessed on 2023-08-16) |

| [10] | Hawker E (2023) Carbon Markets Nurture Biodiversity Solutions. https://www.esginvestor.net/carbon-markets-nurture-biodiversity-solutions/. (accessed on 2023-08-16) |

| [11] |

Hu YY (2022) Research progress on biodiversity offsetting. Biodiversity Science, 30, 21266. (in Chinese with English abstract)

DOI |

|

[胡远洋 (2022) 生物多样性抵消的研究进展. 生物多样性, 30, 21266.]

DOI |

|

| [12] | ICVCM Integrity Council for the Voluntary Carbon Market (2023) The Core Carbon Principles: Plus the Program-level Assessment Framework and Assessment Procedure. https://icvcm.org/the-core-carbon-principles/. (accessed on 2023-08-22) |

| [13] | Jing Z, Zhang X (2023) Analysis of the legal realization path of biodiversity offsetting in China. Gansu Theory Research, (2), 89-98. (in Chinese with English abstract) |

| [荆珍, 张鑫 (2023) 我国生物多样性抵消的法律实现路径探析. 甘肃理论学刊, (2), 89-98.] | |

| [14] | Karsenty A (2022) Emmanuel Macron’s “Biodiversity Credits”: What are We Talking about? (Commentary). https://news.mongabay.com/2022/12/emmanuel-macrons-biodiversity-credits-what-are-we-talking-about/. (accessed on 2023-08-16) |

| [15] | Koh NS, Loveridge R, Starkey M, Bennun L, Booth H, Hawkins F, Mitchell W, Prescott G, Rose J (2022) Exploring Design Principles for High Integrity and Scalable Voluntary Biodiversity Credits. The Biodiversity Consultancy, Cambridge. https://www.thebiodiversityconsultancy.com/fileadmin/uploads/tbc/Documents/Resources/Exploring_design_principles_for_high_integrity_and_scalable_voluntary_biodiversity_credits_The_Biodiversity_Consultancy__1_.pdf. (accessed on 2023-08-16) |

| [16] | Lan H (2021) The present and future of biodiversity financing in China. China Ecological Civilization, (6), 43-47. (in Chinese) |

| [蓝虹 (2021) 中国生物多样性融资的现状及未来. 中国生态文明, (6), 43-47.] | |

| [17] | Li JM, Zhang HM, Wang N (2023) Paths and institutional arrangements for the value realization of biodiversity products: Experiences and inspirations of foreign bio- banking. Acta Ecologica Sinica, 43, 198-207. (in Chinese with English abstract) |

| [李京梅, 张慧敏, 王娜 (2023) 生物多样性产品价值实现的路径与制度安排——国外生物多样性银行经验借鉴与启示. 生态学报, 43, 198-207.] | |

| [18] | Liu GY, Yan NY, Yang Q (2022) Optimizing ecological credit accounting to enhance ecosystem functions. China Natural Resources News, 2022-12-02. (in Chinese) |

| [刘耕源, 颜宁聿, 杨青 (2022) 优化生态信用核算提升生态系统功能. 中国自然资源报, 2022-12-02.] | |

| [19] | Liu YB, Tang RN (2021) The impact of ESG on enterprise value. China Asset Appraisal, (11), 81. (in Chinese) |

| [刘云波, 唐仁娜 (2021) ESG对企业价值的影响. 中国资产评估, (11), 81.] | |

| [20] | Lu DY (2022) Brief study of promoting biodiversity conservation by economical measures. Environment and Sustainable Development, 47(4), 50-54. (in Chinese with English abstract) |

| [卢笛音 (2022) 浅谈以经济手段促进生物多样性保护. 环境与可持续发展, 47(4), 50-54.] | |

| [21] | Manuell R (2023) Feature: Biodiversity Crediting to Imminently Face up to the Challenges of Bundling and Stacking with Carbon. https://carbon-pulse.com/212820/. (accessed on 2023-08-16) |

| [22] | Mehrabi Z, Naidoo R (2022) Shifting baselines and biodiversity success stories. Nature, 601, E17-E18. |

| [23] |

Milner-Gulland EJ, Addison P, Arlidge WNS, Baker J, Booth H, Brooks T, Bull JW, Burgass MJ, Ekstrom J, Zu Ermgassen SOSE, Fleming LV, Grub HMJ, von Hase A, Hoffmann M, Hutton J, Juffe-Bignoli D, Kate KT, Kiesecker J, Kümpel NF, Maron M, Newing HS, Ole-Moiyoi K, Sinclair C, Sinclair S, Starkey M, Stuart SN, Tayleur C, Watson JEM (2021) Four steps for the Earth: Mainstreaming the post-2020 global biodiversity framework. One Earth, 4, 75-87.

DOI URL |

| [24] | NatureFinance, Taskforce on Nature Markets (2023) The Future of Biodiversity Credit Markets: Governing High-performance Biodiversity Credit Markets. https://www.naturefinance.net/wp-content/uploads/2023/02/TheFutureOfBiodiversityCreditMarkets.pdf. (accessed on 2023- 08-16) |

| [25] | NGFS Network for Greening the Financial System, INSPIRE (International Network for Sustainable Financial Policy Insights, Research, and Exchange) (2021) Biodiversity and Financial Stability: Exploring the Case for Action. https://www.ngfs.net/en/biodiversity-and-financial-stability-exploring-case-action. (accessed on 2023-11-30) |

| [26] | NSW Department of Planning and Environment (2023) What are Biodiversity Credits? http://www.environment.nsw.gov.au/topics/animals-and-plants/biodiversity-offsets-scheme/buying-selling-credits-market-information/what-are-biodiversity-credits. (accessed on 2023-08-16) |

| [27] | Pollination (2023) State of Voluntary Biodiversity Credit Markets: A Global Review of Biodiversity Credit Schemes. https://pollinationgroup.com/wp-content/uploads/2023/10/Global-Review-of-Biodiversity-Credit-Schemes-Pollination-October-2023.pdf. (accessed on 2023-08-16) |

| [28] | Pollination,Taskforce on Nature Markets (2023) Biodiversity Credit Markets: The Role of Law, Regulation and Policy. https://assets-global.website-files.com/623a362e6b1a3e2eb749839c/6452340b9bcbb3ef3f82e6b6_BiodiversityCreditMarkets.pdf. (accessed on 2023-08-16) |

| [29] | Porras I, Steele P (2020) Making the Market Work for Nature: How Biocredits can Protect Biodiversity and Reduce Poverty. International Institute for Environment and Development (IIED), London & Edinburgh. https://www.iied.org/sites/default/files/pdfs/migrate/16664IIED.pdf. (accessed on 2023-08-16) |

| [30] | Radjabov T (2023) Biodiversity Credit-An Effective Trade-off Mechanism. UNDP, New York. https://www.undp.org/uzbekistan/blog/biodiversity-credit-effective-trade-mechanism#:-:text=Biodiversity%20credit%20is%20a%20financial,biodiversity%20in%20a%20specific%20landscape. (accessed on 2023-08-16) |

| [31] | Sarmiento M, Morgan S (2023) Biodiversity Credits: An Opportunity to Create a New Financing Framework (Commentary). https://news.mongabay.com/2023/02/biodiversity-credits-an-opportunity-to-create-a-new-crediting-framework-commentary/. (accessed on 2023-08-16) |

| [32] |

Tedersoo L, Sepping J, Morgunov AS, Kiik M, Esop K, Rosenvald R, Hardwick K, Breman E, Purdon R, Groom B, Venmans F, Kiers ET, Antonelli A (2024) Towards a co-crediting system for carbon and biodiversity. Plants, People, Planet, 6, 18-28.

DOI URL |

| [33] | The Nature Conservancy (2023) Principles, Characteristics and Applications of High-quality Carbon Credits. (in Chinese) |

| [ 大自然保护协会 (2023) 高质量碳信用的原则、特征和应用.] https://www.tnc.org.cn/content/details27_1440.html. (accessed on 2023-08-16) | |

| [34] | The Wallacea Trust (2023) Methodology for Quantifying Units of Biodiversity Gain. https://wallaceatrust.org/wp-content/uploads/2022/12/Biodiversity-credit-methodology-V3.pdf. (accessed on 2024-02-28) |

| [35] | UNDP United Nations Development Programme (2021) High-integrity Voluntary Carbon Markets (VCM): Emerging Issues in Forest Countries. https://www.undp.org/sites/g/files/zskgke326/files/2021-11/UNDP-High-Integrity-Voluntary-Carbon-Markets-Emerging-Issues-in-Forest-Countries-V2.pdf. (accessed on 2023-08-22) |

| [36] | UNEP FI United Nations Environment Programme Finance Initiative (2022) 150 Financial Institutions, Managing More than $24 Trillion, Call on World Leaders to Adopt Ambitious Global Biodiversity Framework at COP15. https://www.unepfi.org/themes/ecosystems/cop15statement/. (accessed on 2023-08-17) |

| [37] | US Fish and Wildlife Service (2003) Guidance for the Establishment, Use, and Operation of Conservation Banks. US Fish and Wildlife Service, Washington DC. https://www.fws.gov/sites/default/files/documents/conservation-banking-guidance-2003-05-02.pdf. (accessed on 2023- 08-16) |

| [38] | Verra (2022) Nature Credits: Financing Nature Conservation and Restoration. https://verra.org/wp-content/uploads/Verra_NatureCredits_Overview_2022.pdf. (accessed on 2023- 10-20) |

| [39] | Verra (2023) SD VISta Nature Framework v0.1 for Public Consultation. https://verra.org/wp-content/uploads/2023/09/SD-VISta-Nature-Framework-v0.1-for-Public-Consultation.pdf. (accessed on 2023-10-20) |

| [40] | WEF World Economic Forum (2022) Biodiversity Credits: Unlocking Financial Markets for Nature-positive Outcomes. https://www3.weforum.org/docs/WEF_Biodiversity_Credit_Market_2022.pdf. (accessed on 2023-08-16) |

| [1] | Yunyue Peng, Yongmei Luo, Tong Jin, Jiaying Li, Yufeng Chen. Early siting methods and tools for mitigating ecological impacts of onshore centralized photovoltaics and wind farms [J]. Biodiv Sci, 2025, 33(1): 24063-. |

| Viewed | ||||||

|

Full text |

|

|||||

|

Abstract |

|

|||||

Copyright © 2022 Biodiversity Science

Editorial Office of Biodiversity Science, 20 Nanxincun, Xiangshan, Beijing 100093, China

Tel: 010-62836137, 62836665 E-mail: biodiversity@ibcas.ac.cn ![]()