生物多样性 ›› 2024, Vol. 32 ›› Issue (11): 24363. DOI: 10.17520/biods.2024363 cstr: 32101.14.biods.2024363

收稿日期:2024-08-13

接受日期:2024-11-12

出版日期:2024-11-20

发布日期:2024-11-30

通讯作者:

E-mail: 基金资助:

Yang Zhao1, Ye Wang1,*( ), Liming Ding2

), Liming Ding2

Received:2024-08-13

Accepted:2024-11-12

Online:2024-11-20

Published:2024-11-30

Contact:

E-mail: Supported by:摘要:

《昆明-蒙特利尔全球生物多样性框架》提出, 为缩小7,000亿美元的生物多样性资金缺口, 除了需要逐步降低有害补贴(每年5,000亿美元), 还须从“所有来源”每年筹资2,000亿美元, 包括“新的和额外资源”, 如“利用私人资金, 促进混合融资, 激励私营部门投资”和“鼓励绿色债券、影响基金等金融创新” (行动目标19 C/D)。本文从债券背景、结构设计、风险分担和资金模式4方面, 剖析犀牛债券为何能同时吸引风险和收益形态差异化的3类投资者: 全球环境基金(Global Environment Facility, GEF)赠款、财务回报优先投资人、影响力优先投资人, 形成迭加式资本结构的成功原因, 并总结其优势特点与不足, 以期对昆明生物多样性基金探索业务创新、促进混合融资带来启迪, 并据此提出我国规范与扩大生物多样性主题绿色债券的建议。

赵阳, 王也, 丁黎明 (2024) “犀牛债券”对我国绿色债券和昆明生物多样性基金的启示. 生物多样性, 32, 24363. DOI: 10.17520/biods.2024363.

Yang Zhao, Ye Wang, Liming Ding (2024) Implications of the rhino bond for China green bond market and Kunming Biodiversity Fund. Biodiversity Science, 32, 24363. DOI: 10.17520/biods.2024363.

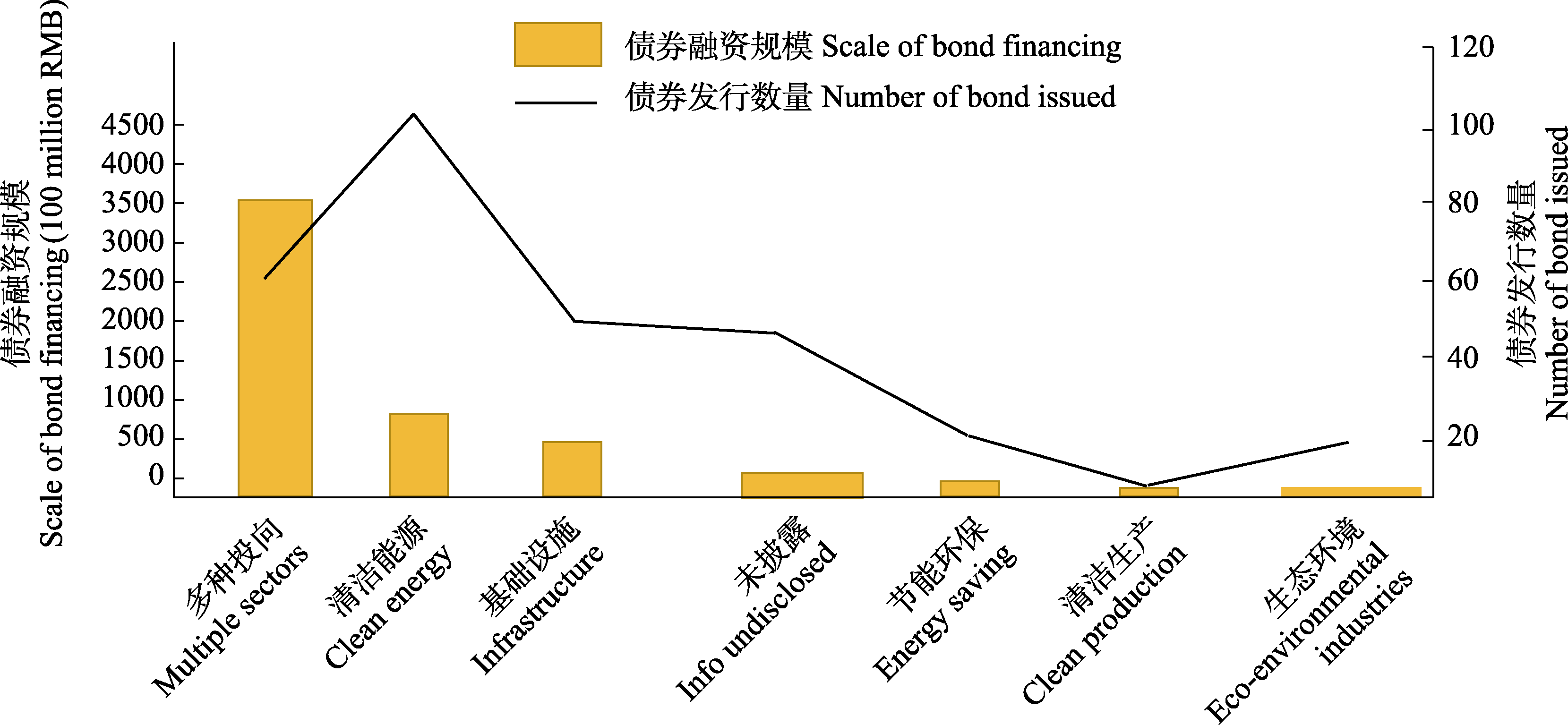

图1 2023年中国境内普通绿色债券融资规模和发行数量(数据来源于中央财经大学绿色金融国际研究院, 2023)

Fig. 1 Financing scale and number of ordinary green bonds issued in China in 2023 (Source from the International Institute of Green Finance, Central University of Finance and Economics, 2023)

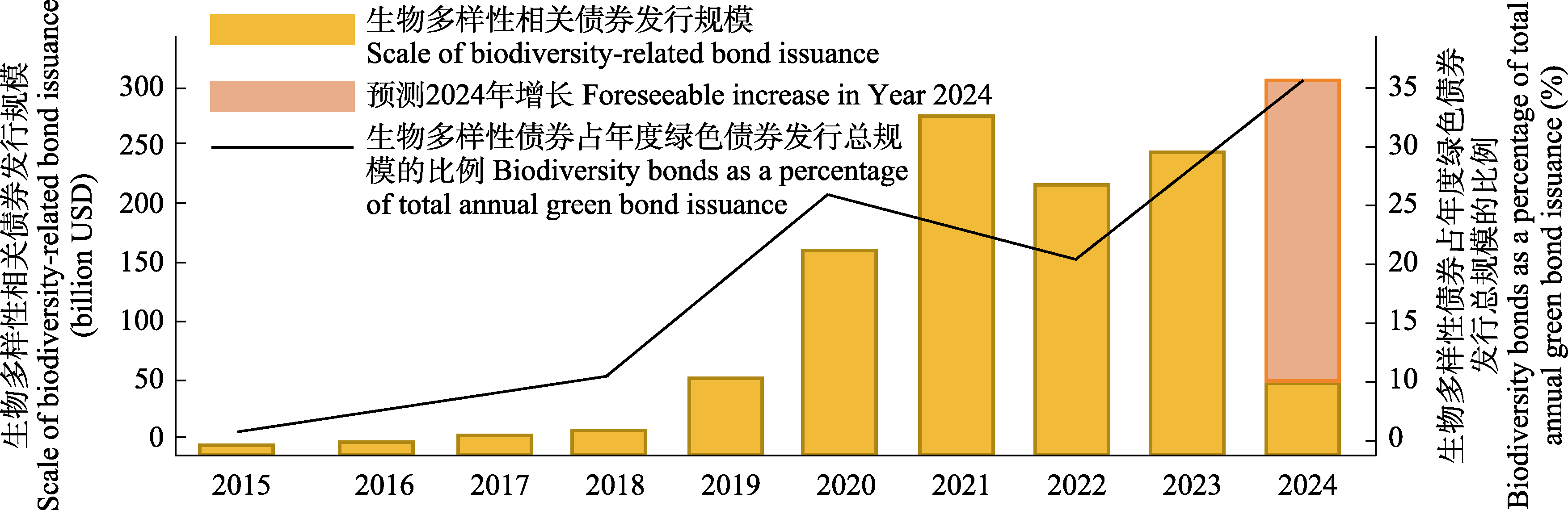

图2 2015-2024年生物多样性相关债券发行及其占年度绿色债券发行总规模的比例(资料来源于国际金融协会(IIF), 数据截至2024年3月28日)

Fig. 2 Biodiversity-related bond issuance and its share of total annual green bound issuance from 2015 to 2024 (Source from International Institute of Finance (IIF), data as of March 28, 2024)

| 国际资本市场协会《绿色债券原则(2021)》International Capital Markets Association’s Green Bond Principles 2021 | 中国《绿色债券支持项目目录(2021)》 China’s Green Bond Supported Project Catalogue 2021 | |

|---|---|---|

| 1. 陆地与水域生态多样性 Terrestrial and aquatic biodiversity 2. 生物资源和土地资源的环境可持续管理 Environmentally sustainable management of biological and land resources 3. 可持续水资源与废水管理 Sustainable water and wastewater management 4. 循环经济产品、生产技术及流程(例如可重复利用、可回收和翻新的材料、组件和产品的设计和推广, 循环工具和服务)和/或经认证的生态高效产品 Circular economy products, production technologies and processes (e.g. design and promotion of reusable, recyclable and refurbished materials, components and products, recycling tools and services) and/or certified eco-efficient products | 4.1.1.1 现代农业种业及动植物种质资源保护 Modern agricultural seed industry and conservation of plant and animal germplasm resources 4.1.1.3 林业基因资源保护 Conservation of forestry genetic resources 4.1.1.4 增殖放流与海洋牧场建设和运营Reproduction and release of aquatic species and construction and operation of marine pastures 4.1.1.5 有害生物灾害防治 Prevention and control of harmful biological disasters 4.2.1.1 天然林资源保护 Protection of natural forest resources 4.2.1.2 动植物资源保护 Protection of plant and animal resources 4.2.1.3 自然保护区建设和运营 Natural reserve construction/operation 4.2.1.4 生态功能区建设维护和运营Construction, maintenance and operation of ecological function areas 4.2.1.5 退耕还林还草和退牧还草工程建设 Projects of returning farmland to forest and grassland, and restoring pasture to grassland 4.2.1.6 河湖与湿地保护恢复 Protection and restoration of rivers, lakes and wetlands 4.2.1.7 国家生态安全屏障保护修复 Protection and restoration of national ecological safety barrier | 4.2.1.8 重点生态区域综合治理 Comprehensive management of key ecological regions 4.2.1.9 矿山生态环境恢复 Mining ecological environment restoration 4.2.1.10 荒漠化、石漠化和水土流失综合治理Comprehensive management of desertification, desertification and soil erosion 4.2.1.11 水生态系统旱涝灾害防控及应对 Prevention and control of droughts and floods in aquatic ecosystems and response 4.2.1.13 采煤沉陷区综合治理 Comprehensive management of coal mining subsidence areas 4.2.1.14 海域、海岸带和海岛综合整治 Comprehensive management of sea waters, coasts and coastal areas 4.2.2.1 森林资源培育产业 Forest resources cultivation industry 4.2.2.2 林下种植和林下养殖产业 Forest plantation and forest breeding industry 4.2.2.3 碳汇林、植树种草及林木种苗花卉 Carbon sink forests, tree and grass planting, and forest tree seedlings and flowers 4.2.2.4 森林游憩和康养产业 Forest leisure and recreation industry 4.2.2.5 国家公园、世界遗产、国家级风景名胜区、国家森林公园、国家地质公园、国家湿地公园等保护性运营 Protective operation of national parks, world heritage sites, national scenic spots, national forest parks, national geo-parks and national wetland parks |

表1 国际资本市场协会《绿色债券原则(2021)》和我国《绿色债券支持项目目录(2021)》在生物多样性主题绿色债券方面的项目分类

Table 1 Classification of projects in terms of biodiversity-themed green bonds in the International Capital Markets Association’s Green Bond Principles 2021 and China’s Green Bond Supported Project Catalogue 2021

| 国际资本市场协会《绿色债券原则(2021)》International Capital Markets Association’s Green Bond Principles 2021 | 中国《绿色债券支持项目目录(2021)》 China’s Green Bond Supported Project Catalogue 2021 | |

|---|---|---|

| 1. 陆地与水域生态多样性 Terrestrial and aquatic biodiversity 2. 生物资源和土地资源的环境可持续管理 Environmentally sustainable management of biological and land resources 3. 可持续水资源与废水管理 Sustainable water and wastewater management 4. 循环经济产品、生产技术及流程(例如可重复利用、可回收和翻新的材料、组件和产品的设计和推广, 循环工具和服务)和/或经认证的生态高效产品 Circular economy products, production technologies and processes (e.g. design and promotion of reusable, recyclable and refurbished materials, components and products, recycling tools and services) and/or certified eco-efficient products | 4.1.1.1 现代农业种业及动植物种质资源保护 Modern agricultural seed industry and conservation of plant and animal germplasm resources 4.1.1.3 林业基因资源保护 Conservation of forestry genetic resources 4.1.1.4 增殖放流与海洋牧场建设和运营Reproduction and release of aquatic species and construction and operation of marine pastures 4.1.1.5 有害生物灾害防治 Prevention and control of harmful biological disasters 4.2.1.1 天然林资源保护 Protection of natural forest resources 4.2.1.2 动植物资源保护 Protection of plant and animal resources 4.2.1.3 自然保护区建设和运营 Natural reserve construction/operation 4.2.1.4 生态功能区建设维护和运营Construction, maintenance and operation of ecological function areas 4.2.1.5 退耕还林还草和退牧还草工程建设 Projects of returning farmland to forest and grassland, and restoring pasture to grassland 4.2.1.6 河湖与湿地保护恢复 Protection and restoration of rivers, lakes and wetlands 4.2.1.7 国家生态安全屏障保护修复 Protection and restoration of national ecological safety barrier | 4.2.1.8 重点生态区域综合治理 Comprehensive management of key ecological regions 4.2.1.9 矿山生态环境恢复 Mining ecological environment restoration 4.2.1.10 荒漠化、石漠化和水土流失综合治理Comprehensive management of desertification, desertification and soil erosion 4.2.1.11 水生态系统旱涝灾害防控及应对 Prevention and control of droughts and floods in aquatic ecosystems and response 4.2.1.13 采煤沉陷区综合治理 Comprehensive management of coal mining subsidence areas 4.2.1.14 海域、海岸带和海岛综合整治 Comprehensive management of sea waters, coasts and coastal areas 4.2.2.1 森林资源培育产业 Forest resources cultivation industry 4.2.2.2 林下种植和林下养殖产业 Forest plantation and forest breeding industry 4.2.2.3 碳汇林、植树种草及林木种苗花卉 Carbon sink forests, tree and grass planting, and forest tree seedlings and flowers 4.2.2.4 森林游憩和康养产业 Forest leisure and recreation industry 4.2.2.5 国家公园、世界遗产、国家级风景名胜区、国家森林公园、国家地质公园、国家湿地公园等保护性运营 Protective operation of national parks, world heritage sites, national scenic spots, national forest parks, national geo-parks and national wetland parks |

| 发布时间 Issuance time | 发行人 Bond issuer | 期限 Validity period | 募集资金规模 Amount of funds raised | 债券募集资金用途 Use of bond funds raised | |

|---|---|---|---|---|---|

| 2023.09 | 海南省政府 Hainan provincial government | 3年 3 years | 10 亿元 1 billion RMB | 票息2.53%, 投向海洋保护、生态修复、种质资源保护和热带特色高效农业项目 Interest rate 2.53%, invested in marine protection, ecological restoration, germplasm resources conservation and tropical agriculture project | |

| 2018 | 天津市政府 Tianjin municipal government | 7年 7 years | 15亿元 1.5 billion RMB | 票息4.02%, 境内首单生态保护专项债券, 投向天津宁河区七里海湿地生态保护修复工程 Interest rate 4.02%, the first domestic special bond for ecological protection, invested in the ecological protection and restoration project of Qilihai Wetlands in Ninghe District of Tianjin Municipality | |

| 2023.03 | 国家开发银行 China Development Bank | 3年 3 years | 150亿元 15 billion RMB | 票息2.65%, 投向长江沿江地带城市轨道交通、污水处理及管网、水生态治理、农村人居环境整治、河湖与湿地保护恢复等绿色项目 Interest rate 2.65%, invested in green projects such as urban rail transportation along the Yangtze River, sewage treatment and pipeline network, water ecology management, rural habitat remediation, restoration of rivers, lakes and wetlands, etc. | |

| 2023.10 | 中国农业发展银行 Agricultural Development Bank of China | 3年 3 years | 43亿元 4.3 billion RMB | 投向矿山生态环境 恢复和碳汇林、植树种草及林木种苗花卉等项目Invested in ecological restoration of mines and carbon sink forests; Projects involving tree planting, grass growing, as well as forest seedlings, flowers, and other related initiatives | |

| 2023.05 | 建设银行悉尼分行 China Construction Bank, Sydney Branch | 3年 3 years | 5亿美元 500 million USD | 投向天然林保护、河湖与湿地保护、退耕还林等项目 Invested in natural forest protection, river, lake and wetland protection, and in returning farmland to forest | |

| 2022.05 | 建设银行悉尼分行和伦敦分行 China Construction Bank Sydney Branch and London Branch | 3年 3 years | 7.8亿美元 780 million USD | “生物多样性”和“一带一路”双主题绿色债券, 投向天然林保护、河湖与湿地保护、退耕还林等项目 Green bond characterized by biodiversity and Belt & Road, invested in natural forest protection, river, lake and wetland protection, and returning farmland to forests | |

| 2022.11 | 中国银行巴黎分行 Bank of China Paris Branch | 3年 3 years | 4亿美元 400 million USD | 投向珍贵植物保护、自然景观生态修复、国家森林保护区、水域环境治理、生态水域环境修复、生态水网建设、湖泊生态保护等项目Invested in precious plant conservation, ecological restoration of natural landscapes, national forest reserves, environmental management of watersheds, etc. | |

| 2021.09 | 中国银行澳门分行 Bank of China Macao Branch | 2年 2 years | 等值18亿元 Equivalent to 1.8 billion RMB | 投向国内生态建设示范、山区生态修复、国家储备林、低质低效林改造等项目 Invested in domestic ecological construction demonstration, ecological restoration of mountainous areas, national reserve forests, low-quality and inefficient forest renovation, etc. | |

| 2018 | 富滇银行 Fu Dian Bank | 3年 3 years | 35亿元 3.5 billion RMB | 票息4.48%, 其中8.89亿元用于异龙湖环境治理、滇池底泥疏浚等项目 Interest rate 4.48%, partial funding of 889 million RMB invested in environmental management of Yilong Lake and dredging of Dianchi Lake’s substrate | |

表2 我国已发行的生物多样性主题绿色债券全部属于“限定募集资金用途类” (UOP)债券类别

Table 2 All biodiversity-themed green bonds issued in China belong to the “restricted use of proceeds” (UOP) bond category

| 发布时间 Issuance time | 发行人 Bond issuer | 期限 Validity period | 募集资金规模 Amount of funds raised | 债券募集资金用途 Use of bond funds raised | |

|---|---|---|---|---|---|

| 2023.09 | 海南省政府 Hainan provincial government | 3年 3 years | 10 亿元 1 billion RMB | 票息2.53%, 投向海洋保护、生态修复、种质资源保护和热带特色高效农业项目 Interest rate 2.53%, invested in marine protection, ecological restoration, germplasm resources conservation and tropical agriculture project | |

| 2018 | 天津市政府 Tianjin municipal government | 7年 7 years | 15亿元 1.5 billion RMB | 票息4.02%, 境内首单生态保护专项债券, 投向天津宁河区七里海湿地生态保护修复工程 Interest rate 4.02%, the first domestic special bond for ecological protection, invested in the ecological protection and restoration project of Qilihai Wetlands in Ninghe District of Tianjin Municipality | |

| 2023.03 | 国家开发银行 China Development Bank | 3年 3 years | 150亿元 15 billion RMB | 票息2.65%, 投向长江沿江地带城市轨道交通、污水处理及管网、水生态治理、农村人居环境整治、河湖与湿地保护恢复等绿色项目 Interest rate 2.65%, invested in green projects such as urban rail transportation along the Yangtze River, sewage treatment and pipeline network, water ecology management, rural habitat remediation, restoration of rivers, lakes and wetlands, etc. | |

| 2023.10 | 中国农业发展银行 Agricultural Development Bank of China | 3年 3 years | 43亿元 4.3 billion RMB | 投向矿山生态环境 恢复和碳汇林、植树种草及林木种苗花卉等项目Invested in ecological restoration of mines and carbon sink forests; Projects involving tree planting, grass growing, as well as forest seedlings, flowers, and other related initiatives | |

| 2023.05 | 建设银行悉尼分行 China Construction Bank, Sydney Branch | 3年 3 years | 5亿美元 500 million USD | 投向天然林保护、河湖与湿地保护、退耕还林等项目 Invested in natural forest protection, river, lake and wetland protection, and in returning farmland to forest | |

| 2022.05 | 建设银行悉尼分行和伦敦分行 China Construction Bank Sydney Branch and London Branch | 3年 3 years | 7.8亿美元 780 million USD | “生物多样性”和“一带一路”双主题绿色债券, 投向天然林保护、河湖与湿地保护、退耕还林等项目 Green bond characterized by biodiversity and Belt & Road, invested in natural forest protection, river, lake and wetland protection, and returning farmland to forests | |

| 2022.11 | 中国银行巴黎分行 Bank of China Paris Branch | 3年 3 years | 4亿美元 400 million USD | 投向珍贵植物保护、自然景观生态修复、国家森林保护区、水域环境治理、生态水域环境修复、生态水网建设、湖泊生态保护等项目Invested in precious plant conservation, ecological restoration of natural landscapes, national forest reserves, environmental management of watersheds, etc. | |

| 2021.09 | 中国银行澳门分行 Bank of China Macao Branch | 2年 2 years | 等值18亿元 Equivalent to 1.8 billion RMB | 投向国内生态建设示范、山区生态修复、国家储备林、低质低效林改造等项目 Invested in domestic ecological construction demonstration, ecological restoration of mountainous areas, national reserve forests, low-quality and inefficient forest renovation, etc. | |

| 2018 | 富滇银行 Fu Dian Bank | 3年 3 years | 35亿元 3.5 billion RMB | 票息4.48%, 其中8.89亿元用于异龙湖环境治理、滇池底泥疏浚等项目 Interest rate 4.48%, partial funding of 889 million RMB invested in environmental management of Yilong Lake and dredging of Dianchi Lake’s substrate | |

| 犀牛数量增长率 Rhino population growth rate (%) | GEF按效支付奖金比例 GEF proportion of bonuses paid based on performance (%) | 债券实际收益率 Actual bond yield rate (%) |

|---|---|---|

| 0或以下 0 or less | 0 | 1.06 (最低收益率 Minimum yield) |

| 0-2 | 40 | 1.79 |

| 2-4 | 80 | 2.5 |

| 4或以上 4 or more | 100 | 2.83 (最高收益率 Maximum yield) |

表3 投资者的浮动收益率取决于全球环境基金(GEF)为保护区犀牛数量增长而支付的奖金比例

Table 3 Investors’ variable rate of return depends on the proportion of bonus paid by Global Environmental Facility (GEF) for rhino population growth

| 犀牛数量增长率 Rhino population growth rate (%) | GEF按效支付奖金比例 GEF proportion of bonuses paid based on performance (%) | 债券实际收益率 Actual bond yield rate (%) |

|---|---|---|

| 0或以下 0 or less | 0 | 1.06 (最低收益率 Minimum yield) |

| 0-2 | 40 | 1.79 |

| 2-4 | 80 | 2.5 |

| 4或以上 4 or more | 100 | 2.83 (最高收益率 Maximum yield) |

| [1] | Asensio JC, Blaquier D, Sedemund J (2022) Biodiversity and Development Finance: Main Trends, 2011-2020. OECD Development Co-operation Working Papers. https://www.oecd-ilibrary.org/development/biodiversity-and-development-finance_b04b14b7-en. (accessed on 2023-08-21) |

| [2] | CBD (Convention on Biological Diversity) (2022) Kunming- Montreal Global Biodiversity Framework: Draft Decision Submitted by the President. https://www.cbd.int/doc/c/e6d3/cd1d/daf663719a03902a9b116c34/cop-15-l-25-en.pdf. (accessed on 2023-08-21) |

| [3] | Central University of Finance and Economics (2023) China Green Bonds Annual Report 2023. (in Chinese) |

| [中央财经大学绿色金融国际研究院 (2023) 中国绿色债券年报.] https://iigf.cufe.edu.cn/info/1013/8417.htm. (accessed on 2024-06-17) | |

| [4] | Deutz A, Heal GM, Niu R, Swanson E, Townshend T, Zhu L, Delmar A, Meghji A, Sethi SA, Tobin-de la Puente J, (2020) Financing Nature: Closing the Global Biodiversity Financing Gap. The Paulson Institute, The Nature Conservancy, and the Cornell Atkinson Center for Sustainability. https://www.paulsoninstitute.org/conservation/financing-nature-report. (accessed on 2024-06-17) |

| [5] | Global Environment Facility (2017) The Global Environment Facility Faces Critical Choices to Enhance Its Impact. (in Chinese) |

| [全球环境基金 (2017) 全球环境基金面临提升影响力的关键抉择] https://www.thegef.org/sites/default/files/council-meeting-documents/OPS5_Final_Report_Summary_Version_-_Chinese.pdf. (accessed on 2024-06-17) | |

| [6] | Hu XL, Cui Y (2024) Progress and development suggestions of biodiversity thematic bonds. Journal of Sustainable Development Economics, (4), 32-35. (in Chinese) |

| [胡晓玲, 崔莹 (2024) 生物多样性主题债券进展及发展建议. 可持续发展经济导刊, (4), 32-35.] | |

| [7] | Illes A, Russi D, Kettunen M, Robertson M (2017) Innovative Mechanisms for Financing Biodiversity Conservation. https://ieep.eu/wp-content/uploads/2022/12/IFM-Mexico-Europe_2019.pdf. (accessed on 2024-08-16) |

| [8] | International Capital Market Association (ICMA) (2021) Green Bond Principles. (in Chinese) |

| [国际资本市场协会 (2021) 绿色债券原则] https://www.icmagroup.org/assets/documents/Sustainable-finance/2021-updates/Green-Bond-Principles-June-2021-100621.pdf. (accessed on 2024-08-16) | |

| [9] | Li Q, Zhang K, Wang L (2022) Where’s the green bond premium? Evidence from China. Finance Research Letters, 48, 102950. |

| [10] | OECD (Organisation for Economic Co-operation and Development) (2020) A Comprehensive Overview of Global Biodiversity Finance. https://www.oecd.org/en/publications/a-comprehensive-overview-of-global-biodiversity-finance_25f9919e-en.html. (accessed on 2024-08-29) |

| [11] | Peng X, Jin R (2022) Inspiration of world bank rhino bond on innovation of biodiversity conservation financing mode. Environmental Protection, 50(20), 74-75. (in Chinese) |

| [彭翔, 金芮 (2022) 世界银行“犀牛债”对创新生物多样性保护融资模式的启示. 环境保护, 50(20), 74-75.] | |

| [12] | People’s Bank of China, Development and Reform Commission and Securities and Futures Commission (2021) China’s Green Bond Supported Project Catalogue (2021). (in Chinese) |

| [中国人民银行, 国家发展和改革委员会, 中国证券监督管理委员会 (2021) 绿色债券支持项目目录(2021).] https://www.gov.cn/zhengce/zhengceku/2021-04/22/5601284/files/48dd95604d58442da1214c019b24228f.pdf. (accessed on 2024-08-16) | |

| [13] | Qiu CG (2023) Characteristics, Status and Trends of Impact Investment. (in Chinese) |

| [邱慈观 (2023) 影响力投资的特质、现况和发展趋势.] https://new.qq.com/rain/a/20231101A06 Z9T00. (accessed on 2024-06-17) | |

| [14] | Sarmiento M, Morgan S (2023) Biodiversity Credits: An Opportunity to Create a New Financing Framework (Commentary). https://news.mongabay.com/2023/02/biodiversity-credits-an-opportunity-to-create-a-new-crediting-framework-commentary/. (accessed on 2023-08-16) |

| [15] | Sguazzin A (2022) Rhino Bond Sold by World Bank in First Issuance of Its Kind (3). https://news.bloomberglaw.com/capital-markets/rhino-bond-is-sold-by-world-bank-in-first-issuance-of-its-kind. (accessed on 2024-06-17) |

| [16] | Tang YZ, Liu QY (2022) Can the “Rhinoceros Debt” Model Accelerate Biodiversity Finance? (in Chinese) |

| [汤盈之, 刘勤一 (2022) “犀牛债”模式能否加速生物多样性融资.] http://www.tanpaifang.com/tanzhaiquan/202206/1787561.html. (accessed on 2024-06-17) | |

| [17] | The International Finance Corporation (2023) Biodiversity Finance Reference Guide. (in Chinese) |

| [国际金融公司 (2023) 生物多样性金融参考指南.] https://www.ifc.org/content/dam/ifc/doc/mgrt/biodiversity-finance-reference-guide-cn.pdf. (accessed on 2024-08-16) | |

| [18] | Wang Y, Xu N (2016) The development of Chinese green bonds and a comparative study of Chinese and foreign standards. Finance Forum, 21(2), 29-38. (in Chinese) |

| [王遥, 徐楠 (2016) 中国绿色债券发展及中外标准比较研究. 金融论坛, 21(2), 29-38.] | |

| [19] | Zhao Y (2021) Enterprises Participated in Biodiversity Case Study and Industry Analysis. Shanghai Science and Technology Academic Publishing House, Shanghai. (in Chinese) |

| [赵阳 (2021) 企业参与生物多样性案例研究和行业分析. 上海科学技术文献出版社, 上海.] | |

| [20] | Zhao Y, Liu Y (2022) Green finance and biodiversity conservation (Chapter 9). In: China Green Financial Development Report (eds Zhu XK, Zhou YQ, Wang W), pp. 298-330. China Finance Publisher, Beijing. (in Chinese) |

| [赵阳, 刘援 (2022) 绿色金融与生物多样性保护. 见: 中国绿色金融发展研究报告(朱信凯, 周月秋, 王文主编), 第298-330页. 中国金融出版社, 北京.] | |

| [21] | Zhao Y, Liu YQ, Wan X, Ding LM (2024) Study on market-based realization of ecosystem product value in national parks: Taking biodiversity offsets and credits as an example. National Park, 2, 296-307. (in Chinese with English abstract) |

| [赵阳, 刘艳青, 万霞, 丁黎明 (2024) 国家公园生态产品市场化新路径——以生物多样性抵消和信用机制为例. 国家公园(中英文), 2, 296-307.] |

| No related articles found! |

| 阅读次数 | ||||||

|

全文 |

|

|||||

|

摘要 |

|

|||||

备案号:京ICP备16067583号-7

Copyright © 2022 版权所有 《生物多样性》编辑部

地址: 北京香山南辛村20号, 邮编:100093

电话: 010-62836137, 62836665 E-mail: biodiversity@ibcas.ac.cn

![]()